You've probably noticed interest charges on your monthly card statement if you carry a revolving balance from month to month. Do you have any concerns regarding how these fees are determined? You can empower yourself to make the greatest financial decisions for yourself and your family by keeping in mind only a few details about credit card interest.

What is the APR on my credit card, and how does it work?

The annual percentage rate, or APR, that applies to your credit card purchases is a set interest rate. Depending on variables like credit scores and your credit card provider, this value will vary from card to card and person to person. Credit card issuers use your APR, calculated over a year, to determine costs for your monthly statement period. APR calculates interest over a year, similar to "miles per hour," which calculates speed over an hour. However, the measurement can be applied in both situations for longer or shorter periods.

How much is credit card interest calculated, and how much is it?

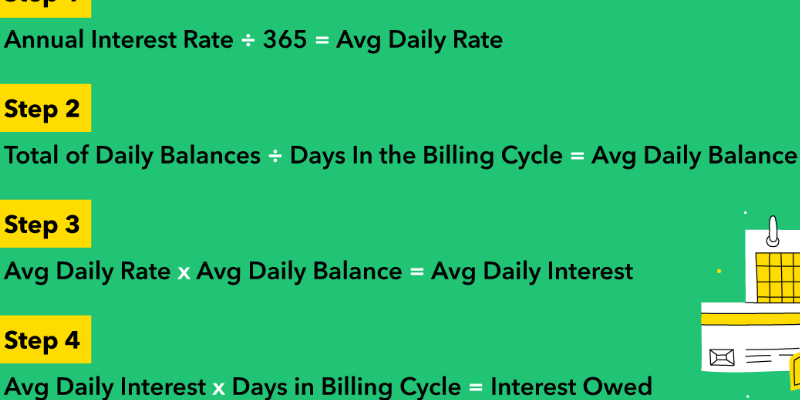

You can convert your APR to a daily percentage rate to see how much interest you pay on your debt daily. Divide your APR by 365 days in a year to achieve this. The card issuer will calculate the daily interest charge by multiplying your current balance by the daily rate at the end of each day. Compounding is how that charge is later added to your account balance the following day.

Payments or credits.

Your credit card will have a daily rate of 0.041096% if your APR is 15%. Consider a cardholder with a $1,000 amount with a 15% APR standard interest rate. The sum is increased the following day by interest, new purchases, and new credits or payments, resulting in a final balance of $1,000.41. Up to the end of the cardholder's monthly statement cycle, this process happens every day. As a result, after the month, the $1,000 starting debt has increased to $1,013 thanks to interest charges with a 15% APR.

When does credit card interest begin to accrue?

The good news about credit card interest is that most firms provide you with a grace period before making a transaction. If a grace period is in effect, the credit card company will not charge you interest on purchases if you pay off the entire balance by the due date each month.

Agreement On Specifics

The cardholder has forfeited their grace period, and the interest charges will normally show up on the subsequent statement if they do not pay the whole statement balance or do not make their payment on time. But for information particular to their account, cardholders should always consult their cardmember agreement.

Is it possible for a credit card to have more than one interest or APR?

Cardholders' cash advance balance and balance transfer balances may be subject to different interest rates and fees. In addition, when cardholders don't make payments, many credit cards charge a higher penalty interest rate.

Interest rates might rise.

The prime rate can affect the majority of Interest Rates on Credit Cards, Which Can Vary. The prime rate is an interest rate determined by the Federal Reserve Bank and is three percentage points higher than the federal funds rate. Cardholders should avoid accruing more interest charges than they can conveniently pay each month because this interest rate may grow.

Making the best financial decisions for yourself and your family will be easier if you keep these basic credit card interest statistics in mind. To calculate the interest and length of time, it will take to pay off any credit card, use Discover's interest calculator.

Find out what interest rates apply to purchases.

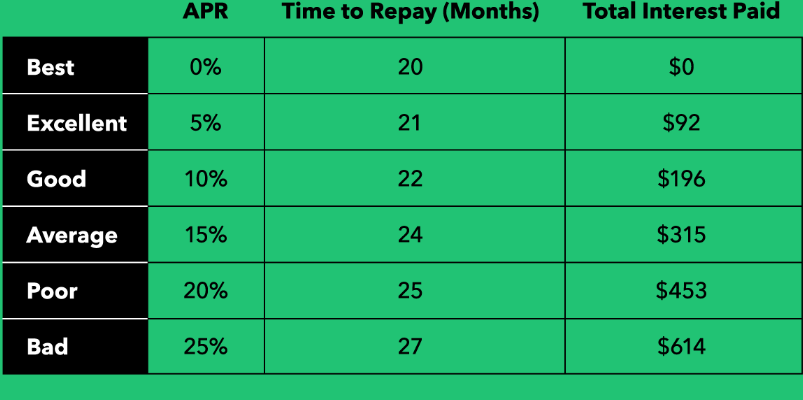

It's crucial to carefully explore the finest credit card choice for you because each provider and each specific credit card they offer has their unique set of terms that will determine the APR you may pay on purchases you make. By carefully planning your credit strategy with an understanding of these terms, you can earn the points or cash-back rewards of your choice or raise your credit score gradually over time.

Usually Provides Credit Cards

Credit cards issued by Discover typically include introductory APRs as low as 0% for a set period of time, after which the variable Purchase APR applies to any remaining balance. As you progress in your quest to find the best credit card for your needs, you'll need to become familiar with such topics as how your credit score interacts with the minor terms that distinguish other credit card providers, where to start building credit, and how annual percentage rates (APRs) are calculated.