Are you considering investing in an annuity? If so, knowing the differences between ordinary and due annuities is important. The two contracts differ slightly but can greatly impact your return rate and when you will begin receiving payments.

Before making any decisions, let's look at the similarities and differences between ordinary annuity vs. annuity due.

Introducing the Concept of Annuities

Annuities are contracts between an individual and a life insurance company in which the insurer agrees to make periodic payments of either a set or variable amount.

Ordinary annuities and annuities due differ in how those payments are structured, but both can provide financial security for retirees or other individuals.

Definition of Ordinary Annuity

An ordinary annuity is an investment contract that pays out fixed-income payments at regular intervals for a predetermined period.

This type of annuity usually makes payments at the end of each term and begins making payments immediately after your initial investment.

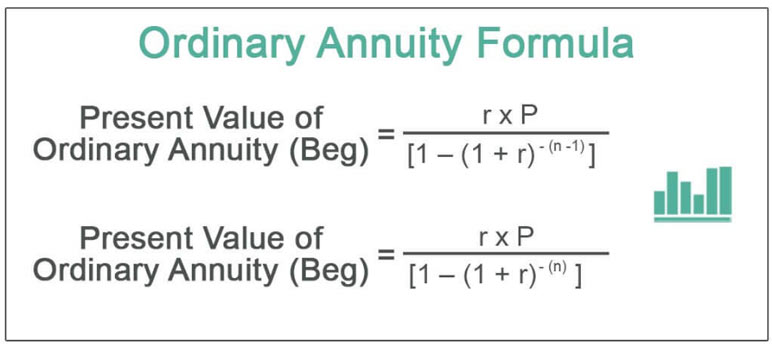

Formula

The formula used to calculate ordinary annuity payments includes the present value of the investment, the interest rate on the annuity, and the number of annuities that will be paid out.

What is an example of an ordinary annuity?

A great example of an ordinary annuity is a certificate of deposit (CD). With a CD, you invest a certain amount into the bank account and earn a set interest rate on the principal investment, plus any interest that has accrued during the term of the CD.

Definition of Annuity Due

A type of financial contract known as an annuity due distributes fixed income payments at regular intervals over a defined time.

Ordinary and annuities are due primarily because payments are made at the start of each term rather than at the conclusion.

This means that you will begin receiving your payments immediately after investing in an annuity due.

Formula

The formula used to calculate annuity due payments includes the present value of the investment, the interest rate on the annuity, and the number of annuities that will be paid out. An additional factor is added to the equation to account for the difference in payment timing.

What is an example of an Annuity Due?

A great example of an annuity due is a deferred income annuity (DIA).

With this type of annuity, you invest a certain amount of money into the account and begin receiving payments immediately, but those payments will be smaller than if you had invested in an ordinary annuity.

The advantage of a DIA is that you can begin receiving your payments immediately.

Pros and cons of Ordinary and Annuity Due:

Ordinary Annuity

Pros

- Lower initial investment

- Payments begin immediately

- More flexibility regarding when payments are made

- Lower taxes

Cons

- Lower returns

- Less liquidity

- Limited to fixed payment amounts

- No accumulation of interest

Annuity Due

Pros

- Higher returns

- More liquidity

- Ability to accumulate interest

- Increased stability

Cons

- Higher initial investment

- Payments begin immediately

- Limited flexibility in payment timing

- Higher taxes

By understanding the similarities and differences between ordinary annuities vs. annuities due, you can make an informed decision when investing in annuities.

Do your research and consult a financial advisor before making any decisions.

Factors to consider when deciding which annuity type is right for you

- Your Financial Goals

Take the time to assess your financial goals and determine which annuity type will best help you meet those goals.

- Your Time Horizon

Think about how long you want to invest in an annuity and if there is a certain timeline for when to start receiving payments.

- Your Investment Capacity

Consider how much you have to invest and how much risk you are willing to take.

- Your Tax Situation

Understand your tax situation and how it may affect your annuity payments.

- Your Risk Tolerance

Evaluate how much risk you are comfortable taking and ensure the annuity type reflects that risk tolerance.

When making an informed decision about your investment, it is important to understand the similarities and differences between ordinary and annuities to make the best choice for your financial future.

Tips for getting the most out of your annuity investment

- Shop Around

Take the time to research different annuity types and providers to find the best rate for your investment.

- Consider Your Options Carefully

Consider what type of annuity is right for you and if the terms are beneficial.

- Understand All Fees & Penalties

Research all fees, commissions, and penalties associated with your annuity and ensure you understand the terms before signing a contract.

- Monitor Your Investment Performance

Please keep track of your investment performance over time to ensure it meets your financial goals.

- Seek Professional Financial Advice

Consult a professional financial advisor for more in-depth advice on selecting an annuity type and provider that works best for you.

- Review Your Contract

Ensure you read your contract thoroughly and understand all the terms before signing.

By knowing the important similarities and differences between ordinary annuity vs. annuity due and considering these tips for getting the most out of your investment, you can make an informed decision to protect your financial future.

Tax Implications of Annuities

Annuities are subject to certain tax implications depending on the type of annuity and how it is structured. Generally, annuities are treated as before-tax investments, meaning that taxes must be paid on any gains made.

Annuity payments can also be taxed differently depending on if they are considered ordinary income or qualified distributions.

It is important to consult a financial advisor or tax professional to understand annuities' tax implications and ensure you are properly filing.

Which Annuity Is Best?

Your best type of annuity will depend on your financial goals and risk tolerance. Consider all factors before deciding, such as your time horizon, investment capacity, tax situation, and the fees associated with each annuity type.

Be sure to consult a financial advisor or tax professional for more in-depth advice about which annuity is right for you.

Investing in an annuity can be a great way to secure your financial future and ensure that you are receiving consistent income for the long term.

By understanding the similarities and differences between ordinary annuity vs. annuity due, you can decide when to choose an annuity type that will best meet your needs.

With proper research and guidance, investing in an annuity can greatly protect your financial future.

FAQs

Why is an ordinary annuity better than an annuity due?

Ordinary annuities are beneficial because they provide a fixed payment for an agreed-upon period. With an annuity due, payments begin immediately; thus, the return rate may be higher but will last for a shorter time.

What is the safest type of annuity?

The safest type of annuity is a fixed or deferred annuity. With this type of contract, you will receive a guaranteed return rate regardless of market conditions or policy changes. This ensures that you will have a steady income even during financial uncertainty.

What is the difference between an annuity due and a deferred annuity?

With delayed annuities, you can invest money over time by making recurring payments into the policy until a predetermined date. On the other hand, immediate payment is paid into the policy for an annuity due, and the payments start right away. The due annuity will have a higher return rate but a shorter lifespan.

Conclusion

Knowing the differences between ordinary and due is essential when investing in annuities. Understanding the similarities and differences between the two will help you make a more informed decision and take advantage of the right contract for your financial needs. Ultimately, both ordinary annuities and due annuities can be beneficial investments. It's just a matter of deciding which contract works best for you.