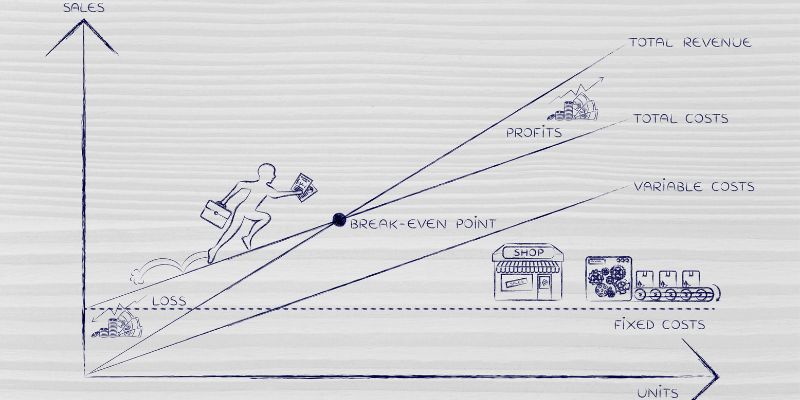

Businesses are taking longer than before to generate profits, and it's vital to understand the breakeven points for the companies to get lucrative results. Breakeven points help to understand the financial health of a business and assist in generating a better financial strategy for the future. In this article, we are going to explain what is breakeven point with some examples and how to calculate it.

What is the Breakeven Point?

The Breakeven point for any investment or trading method is calculated by the market price of the asset and the original costs. The calculations reach the breakeven point when the market price and the original costs of an asset become equal at some point.

For large businesses and firms, the breakeven point is determined by the BEP formula. The BEP formula is dividing the defined fixed costs related to production by the revenue per unit, subtracting the variable costs per unit. In such a case, the fixed costs do not vary based on the number of units sold.

What are the Benefits of Finding the Breakeven Point?

The Breakeven point determines the financial state of a business, and it is beneficial to calculate for the following reasons:

Discovering Missing Expenses

Whether you are running a large-scale or small business, calculating expenses can always be a hassle. With the help of a breakeven analysis, you can find any missing expenses in your business that you may not be expecting. Moreover, the financial commitments for these expenditures can be found at the end of the breakeven analysis. Hence, there won't be any surprises in the future.

Limiting Emotional Decisions

Conducting business on the basis of emotions can sometimes result in irreversible loss. It's rarely a good idea, and it is challenging to avoid when you are dealing with a range of individuals. A breakeven analysis highlights the hard facts for you and gives you a clear point of view, which can help you to make better decisions.

Set Financial Goals

By calculating the breakeven point, you will know the exact goals you need to achieve in order to make a profit. Setting financial goals can stabilize your business in the long run and helps to keep things within budget, unless there are some unfortunate circumstances. Once you set the financial goals, you can work towards them by streamlining your business activities.

Secure Funds

The breakeven point is a good calculation to convince investors that you have analyzed the financial areas to achieve the goals of your business. It shows the credibility of your financial plan and how what type of stability you plan to bring with your financial goals.

Appropriate Pricing

With the breakeven point calculation, you will understand the costs and revenue generation per unit in your business. Hence, you will be able to price the products in your business more appropriately. Moreover, you can cover the overpricing challenges and compete for a lucrative option as compared to other businesses in your market.

How to Calculate Breakeven Point

To calculate breakeven point, there are two different formulas:

Method #1: Breakeven Point in the Units

- Break-Even Point (units) = Fixed Costs / (Sales price per unit – Variable costs per unit)

Fixed Costs: The fixed costs in any business don't usually change or change very slightly, depending on the circumstances or misfortunes. The fixed costs usually refer to the monthly rentals or utility bills or a business that is predictable.

Sales Price Per Unit: The sales price per unit defines how much a company would charge its customers for a single product (for which we are doing the calculation).

Variable Costs Per Unit: Variable costs are directly attached to the amount of production of a product. For example, how much labor you hired or how much material was required to make that product. Variable costs often change over time and they are usually the biggest expense of a business.

Example of Breakeven Point in Units

Trevor's Soda Company is situated in Dallas, Texas. Trevor is now thinking of introducing a new soft drink in the market known as Trevor's Sparkling Fizz. Now, he wants to know what type of impact this new drink would have on the company's finances. Hence, he decides to calculate breakeven point using units, where his investments stand as:

Fixed Costs = $2500 (per month)

Variable Costs = $0.40 (per unit produced)

Sale Price = $1.7 (per can)

Breakeven Point = $2500/($1.7-$0.40) = 1923 units.

Method #2: Breakeven Point in Dollar Sales

- Break-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin

The contribution price in this type of calculation is calculated by subtracting the price of a product and how much it costs to make that product. Hence, the formula for the Contribution margin would be:

(Sale price per unit – Variable costs per unit)/Sale price per unit

Using the same example of Trevor's Soda company, the Contribution Margin would be $0.76

Now let's apply these calculated figures in the formula to find out if Trevor's Soda can breakeven the point in Dolla Sales.

$2500/$0.76 = $3289

It means the Trevor's Soda company has to sell $3289 price worth of new Fizzy soda cans in a month to break even. Any figure beyond that amount would be considered as the profit for the company. Hence, the Trevor's Soda Company can further calculate the profits or loss in their business by following the same formula.

Conclusion

The breakeven point is a useful tool for companies who are going to launch a new product and want to get predictions on their expenses. It also uncovers any unknown expenditures that you may not be expecting during the calculations. By finding the breakeven point, you can make better financial decisions for your business to get lucrative results in the long run. Hopefully, this article has guided you well on what is breakeven point is and how to calculate it.